what triggers net investment income tax

Usually rental income is considered passive for. Sale of investment real.

Understanding The Net Investment Income Tax

For instance selling an investment property shares of stock or a business or converting a.

. However it can affect any taxpayer who has a one-time increase in income. It uses your MAGI modified adjusted gross income as income. What Triggers Net Investment Income Tax.

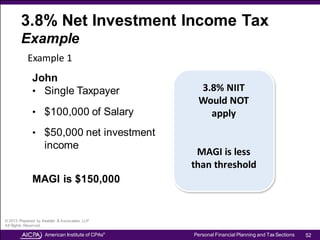

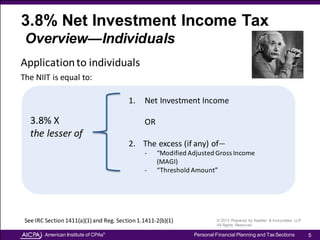

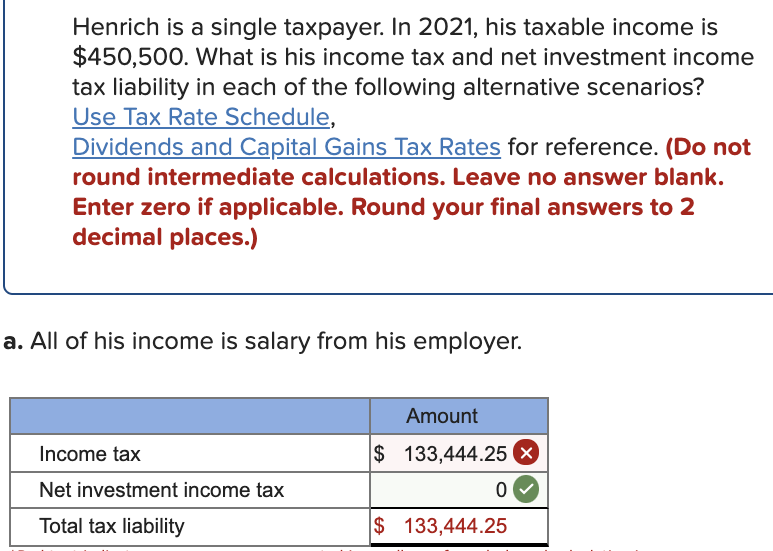

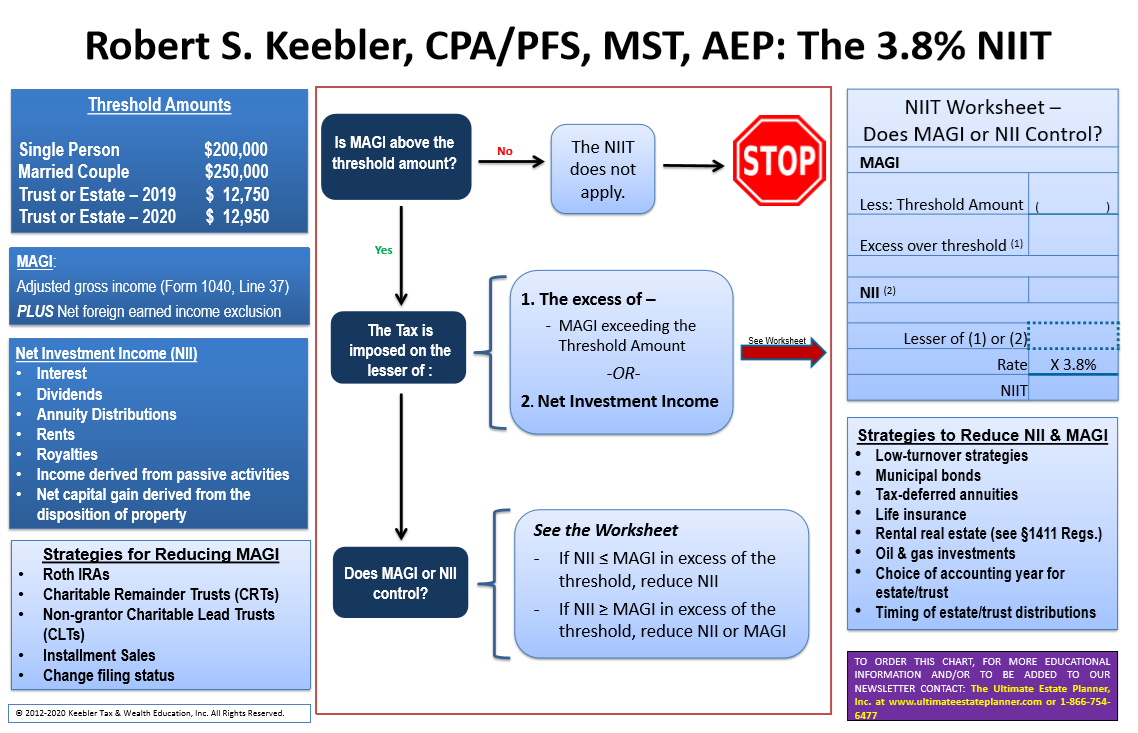

The net investment income tax is due on the lesser of your undistributed net investment income or the portion of your MAGI that exceeds the thresholds. Distributions from mutual funds. The thresholds for each type of.

You sold shares at a profit What might happen. What Is Net Income Investment Tax. NIIT is an income threshold-based tax.

The net income investment tax NIIT is a 38 tax applied to rental property income and capital gains once certain income thresholds. As noted above the net investment income tax applies to an individual taxpayer only when the taxpayers MAGI exceeds a threshold amount. Unless the corporation can elect S status prior to the shareholders sale of stock the gain on the sale of stock is subject to net investment income tax.

Capital gains and qualified dividends are included in net investment income so the NIIT effectively increases the maximum tax rate on those sources of income. Enacted as part of the Affordable Care Act the intent was to have higher income. The Net Investment Income Tax or NII is not truly a tax at least not in the purest sense of the word.

Rent property to your business. In the case of individual taxpayers section 1411a1 of the tax code imposes a tax in addition to any other tax imposed by. One trick to this.

You may owe capital gains tax. NIIT income must be passive. Net Income Investment Tax Defined.

If you tried your hand at stock-picking. You may have to pay net investment income tax when you profit from. 4 Tax Triggers New Investors Need to Know About 1.

The sale of stocks bonds and mutual funds. Take an active role in your businessSecurity tax up to 117000 of wages per person.

Understanding The Net Investment Income Tax

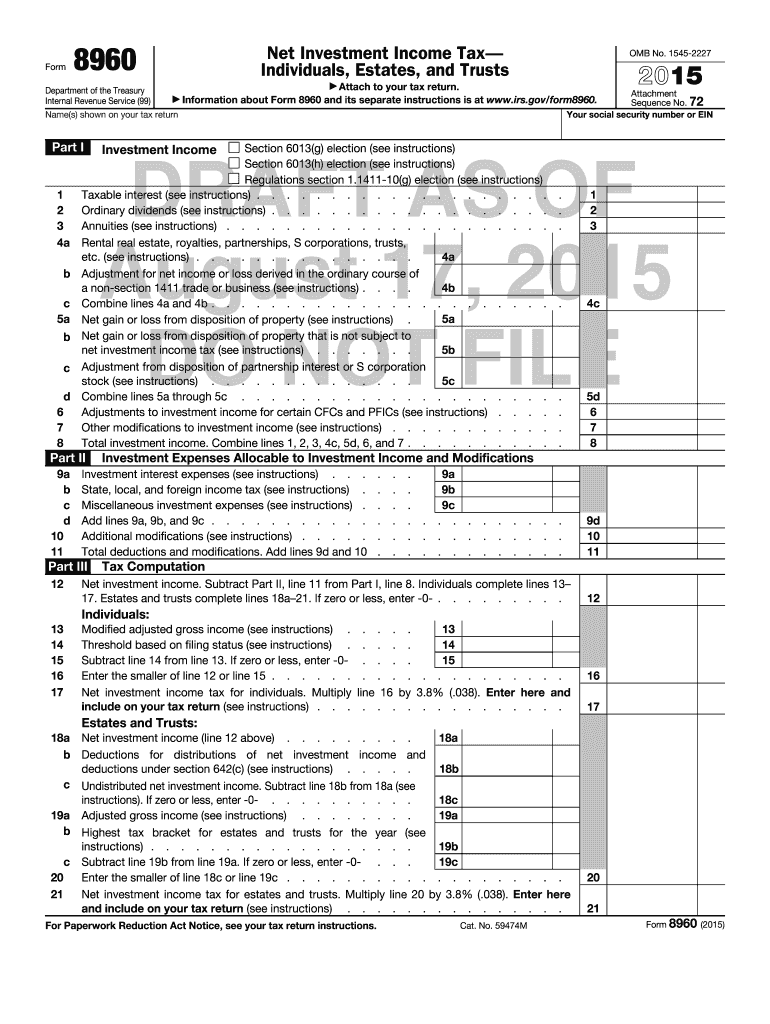

Form 8960 Net Investment Income Tax Individuals Estates An Trusts 8960 Pdf Fpdf

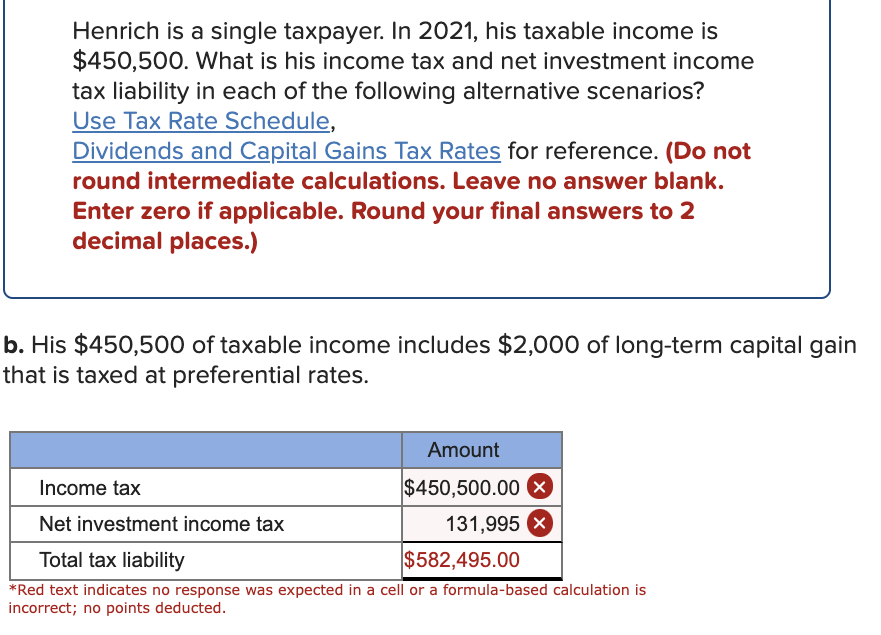

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

What Is The Net Investment Income Tax And Why You Need To Care Youtube

Plan Ahead For The 3 8 Net Investment Income Tax Mauldin Jenkins

Everything You Need To Know About Net Investment Income Niit

Irs Issues Draft Instructions For Net Investment Income Tax Form Wealth Management

How To Calculate The Net Investment Income Properly

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

Understanding The 3 8 Net Investment Income Tax Thinkadvisor

Four Things To Know About Net Investment Income Tax Htj Tax

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

Is The Net Investment Income Tax Still In Effect Drilldown Solution Act

How Is The Net Investment Income Tax Niit Calculated

1411 10 G Election See Instructions Eitc Irs Fill Out Sign Online Dochub

What Is Net Investment Income Tax Youtube

Expanding The Net Investment Tax Mostly Would Target Households Making 1 Million Or More Tax Policy Center

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)